Disclaimers: - No communication should be considered as financial or trading advice. - All information in this lecture/course/seminar are intended and solely for educational purpose only. - They do not constitute investment advice in any manner whatsoever or have any regard to the specific investment objectives, financial situation or individual needs of any particular persons receiving them. - Examples are used for illustrative purposes only and do not constitute investment advice.

Saturday, November 26, 2011

Straits Times Index - Rebounce Soon???

Looking at the chart, likely to see further downside instead. Therefore I will consider Short Sell instead. No point to catch a short upmove and get caught in the wrong side when I am busy with

my Business.

Cheers - Trade to Win.

Sunday, September 11, 2011

Tuesday, June 21, 2011

Is it safe to trade stock in a downtrend? - Genting dated 210611

Well today stock market started to move up but is it time to get in. In every downtrend, allow 1 upday

to happen, if more than 1 upday consecutively occur, then there is a possibility of trend changing and

command further analysis.

In the Genting stock, volume is average with nice price closed near to day's high. In my trading system,

it is not ready to initiate a Long trade as more confirmation will be required. Price must first turns from

Red/Amber to Green Bar, and price must be above the trailing cut loss level which becomes a support

line for the price as it moves higher. Till then, just be patience and stay watching like a wolf waiting for

a good kill.

Saturday, June 18, 2011

Friday, June 10, 2011

Is the Market ready for a rebounce soon?

Overall uptrend still intact, retracement is necessary to flush out weak players so that the stronger players

can accummulate more a base to stage a stronger upmove later. Further downside is expected with

support near 1250 level. Stay watch & cool.

Thursday, June 9, 2011

Early Warnings are Blessing in Disguise

It is always helpful when the system provides early signal of weakness or strenght. I do not take the signal

blindly without double confirm if the overall trend channel has changed.

Just like when you hear from someone that certain stock is a good buy, do not take it as face value, dive

into the chart and perform thorough analysis before you take any action.

Trust yourself, your own money and initiatives. No one will care your financial health report, not

even your boss, friends, and relatives. YOU have to Mind your Own Financial Business and Take Charge Today.

Market has been sideway for a while, I take this as an opportunity to spot stocks for short term trading buy.

Good Luck Ahead!

Friday, May 27, 2011

Be Wary of Extremely High Volume at Upper Channel and May Mean Start of Distribution Activities

How do we know that the current trend has topped and may begin to topple?

This is not difficult to tell if you understand how the professionals will act in the Market.

This kind of massive distribution or transferring of inventories to the unwary investors and

traders usually happen in a bullish day where the news will be good, the particular stock

maybe rumoured to have potential good news and this get the average investors and traders

excite and causes them to take part in the chasing flee.

There is no free lunch, if you are getting advantage out of nowhere then it is time to think about

who is the other side that is selling to you. If the stock is so bullish, won't the other side wants to

hold longer to make more profits?

By understand the price and volume relationship and without complicated technical indicators,

it is possible to learn to see how the stock will response to the actual demand and supply of

everyday trading. Afterall the market is driven by the two strongest emotions of human beings,

GREED and FEAR. By understanding the collective activities of this unwary group of traders or

investors, you can know how the professionals will trade against this group which called the HERD.

This game is mean, there are sharks or wolves waiting for the untrained, greedy and fearful traders

and investors to fall into their traps. Always protect your trade setup with cut loss even if we

are super bullish on a setup, as I said many times, we are dealing with probability and no certainty.

Trade with cautious or consult your personal financial advisor before deciding to take trade.

Cheers

Thursday, May 19, 2011

How I stock trade successfully using my Mobile Phone?

Good Day Traders

After taking up new job early this year, I was not able to trade freely as before. Therefore I have

to rely on the available tools that I have to make my hobby profitable as before. I use my mobile

phone to trade most of the time and now I can really trade freely again.

How I make use of my phone to make trading possible is not without planning? I have studied

how I can make use of the "FREE" software from itunes to alert me when my buy price is near

or the profit taking level has reached. Before that I still do the normal analysis work on the market.

First I would pick up a couple of stocks for analysis and once a particular stock is picked for

potentialtrade the next day, I would have noted the a) entry price, b) cut loss price, c) exit price,

d) take note of the volume if it is above the average or lower.

When a stock is ready to stage a successful upmove, usually the volume will be average to high

and not excessively high. With this information in place, I can start to plan my trade on my phone.

So what I use on my Iphone to assist me with trading ease, the following lists of tools are used:

1) Poems mobile by Philip Security

2) SG Stock Alert "Free" from itunes

First of all, I will run the SG Stock Alert and enter the stock price trigger level for high and low.

For example, if the previous day closed price is $1.00, I will set the high: $1.02, low: $0.97 for the

next day price tracking. The High is the trigger long trade alert while the Low is tell me that the

stock is weak today after open and I will not trade this stock today.

I will enter a stock near market closing most of the time so that I know if the price is near the

high or low of the day before closing. Obviously I want to buy high price near market close with

substantial volume to support the upmove.

When the price triggers $1.02 during the day, it will sound and alert me that a trade to the long

side is possible, I will log on to Poems mobile and check the transacted volume.

If the volume is healthy and above average to high with triggered price level, I will transact using

the phone. I DO NOT QUEUE TO TRADE. I don't queue to sell or buy. When i decide that I

want to buy, I will buy from the sellers' queue and when I sell, I do the same again by selling to

the buyers' queue. Once a transaction is done, an email with transaction information such as lot

size, price level will be sent to my email which I can immediately view my email with push mail

feature on and get back to my normal work routine.

Ok, you may ask me what happen after I bought a stock. I will use the same application, SG stock

alert and set my near term target level and cut loss level. When any of the target level is triggered,

I will look at the chart and decide the appropiate action to sell or to keep.

If you are busy person like me, you may want to try to trade this way, no harm at all. I love the

conveniences and continue to trade profitable even with the phone.

Successful Trading needs to plan, trading is one of the toughest games as it involves the two

weaknesses of mankind, Fear and Greed.

Afterall, trading is just a small part of the game to compound or grow money, the bigger pie will be

investing on rental properties for passive income.

The fun about trading is that we are able to know which industries are performing or underperforming

by analyzing the sector index. By analysis specific Real Estate Index or Construction Index,

we are able to tell if the property sector is undervalued or overvalued.

When the property index is in undersold level, it maybe a good time to find value investing in real

properties. e.g. FT Real Estate Index was at the lowest during 2009 Q1.

If you have bought a property since then, you could be laughing away with the bank today.

Don't give up stock trading, don't despair if trading is not going anywhere. Stay positive, education

is very important.

Below is the application that I use for Stock Alert:

After taking up new job early this year, I was not able to trade freely as before. Therefore I have

to rely on the available tools that I have to make my hobby profitable as before. I use my mobile

phone to trade most of the time and now I can really trade freely again.

How I make use of my phone to make trading possible is not without planning? I have studied

how I can make use of the "FREE" software from itunes to alert me when my buy price is near

or the profit taking level has reached. Before that I still do the normal analysis work on the market.

First I would pick up a couple of stocks for analysis and once a particular stock is picked for

potentialtrade the next day, I would have noted the a) entry price, b) cut loss price, c) exit price,

d) take note of the volume if it is above the average or lower.

When a stock is ready to stage a successful upmove, usually the volume will be average to high

and not excessively high. With this information in place, I can start to plan my trade on my phone.

So what I use on my Iphone to assist me with trading ease, the following lists of tools are used:

1) Poems mobile by Philip Security

2) SG Stock Alert "Free" from itunes

First of all, I will run the SG Stock Alert and enter the stock price trigger level for high and low.

For example, if the previous day closed price is $1.00, I will set the high: $1.02, low: $0.97 for the

next day price tracking. The High is the trigger long trade alert while the Low is tell me that the

stock is weak today after open and I will not trade this stock today.

I will enter a stock near market closing most of the time so that I know if the price is near the

high or low of the day before closing. Obviously I want to buy high price near market close with

substantial volume to support the upmove.

When the price triggers $1.02 during the day, it will sound and alert me that a trade to the long

side is possible, I will log on to Poems mobile and check the transacted volume.

If the volume is healthy and above average to high with triggered price level, I will transact using

the phone. I DO NOT QUEUE TO TRADE. I don't queue to sell or buy. When i decide that I

want to buy, I will buy from the sellers' queue and when I sell, I do the same again by selling to

the buyers' queue. Once a transaction is done, an email with transaction information such as lot

size, price level will be sent to my email which I can immediately view my email with push mail

feature on and get back to my normal work routine.

Ok, you may ask me what happen after I bought a stock. I will use the same application, SG stock

alert and set my near term target level and cut loss level. When any of the target level is triggered,

I will look at the chart and decide the appropiate action to sell or to keep.

If you are busy person like me, you may want to try to trade this way, no harm at all. I love the

conveniences and continue to trade profitable even with the phone.

Successful Trading needs to plan, trading is one of the toughest games as it involves the two

weaknesses of mankind, Fear and Greed.

Afterall, trading is just a small part of the game to compound or grow money, the bigger pie will be

investing on rental properties for passive income.

The fun about trading is that we are able to know which industries are performing or underperforming

by analyzing the sector index. By analysis specific Real Estate Index or Construction Index,

we are able to tell if the property sector is undervalued or overvalued.

When the property index is in undersold level, it maybe a good time to find value investing in real

properties. e.g. FT Real Estate Index was at the lowest during 2009 Q1.

If you have bought a property since then, you could be laughing away with the bank today.

Don't give up stock trading, don't despair if trading is not going anywhere. Stay positive, education

is very important.

Below is the application that I use for Stock Alert:

Friday, May 13, 2011

Friday, April 29, 2011

Look to the LEFT when Trading, don't miss important turning point.

Ever wonder why history repeated itself over and over again. As seemed in the chart, what had happened in

June 2007, has repeated again in August 2010 with price headed up to 2007 high and reversed downward.

There is no coincidence at all.Both sold off happened after extremely high transaction volume weeks before where the Smart Money were busy transferring their holdings to their unwary HERD who thought there was further profits to be made. Just too bad, the market is always ready to punish those who are greedy and tried to take advantages of free ride. THERE IS NO FREE RIDE AND LUNCH IN THE MARKET.

It's not difficult to detect Smart Money activity and step out of the way, not getting trick into such

a common trap which happens every now and then.

Get educated & trained. You will be happy to enjoy trading for life!

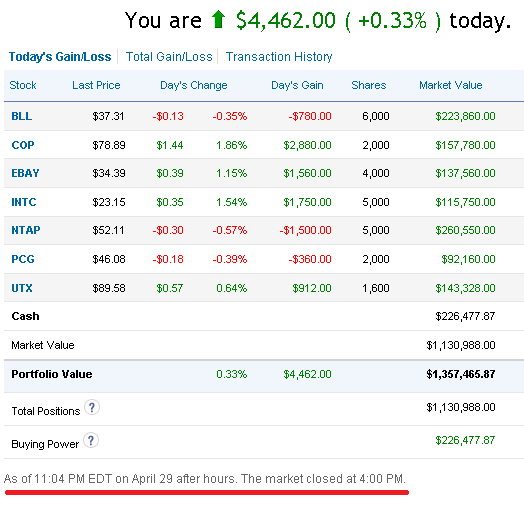

What happen to the US Portfolio after I revised the stocks to replace?

On 23rd April, I did a portfolio update and remove two stocks and replace with a few stocks

that triggered the Blue Diamond "Go Long" expert indicator.

If you miss the earlier post, click on the link below:

http://volume-price-spread-for-metastock.blogspot.com/2011/04/using-same-trading-system-on-us-stocks.html

A week after the portfolio update, the portfolio has gone up usd22K as shown below:

that triggered the Blue Diamond "Go Long" expert indicator.

If you miss the earlier post, click on the link below:

http://volume-price-spread-for-metastock.blogspot.com/2011/04/using-same-trading-system-on-us-stocks.html

A week after the portfolio update, the portfolio has gone up usd22K as shown below:

There is no coincidence or luck factor, this is real stock analysis by understanding the activity of the

Smart Money and trade alongside to increase the opportunity of making good trades.

How to trade without Technical Indicators and Still Do Well?

There is no secret in my trading strategy. Without using complicated formulas to create lagging indicators,

I am better off using the only real time leading indicators, Price and Volume only.

By classifying a stock into CLASS A (stock without know resistance on the left), CLASS B (stock with

multiple resistances on the left), CLASS C (stock that is moving down with lower peaks)

By classifying a stock into 4 Stages, Stage 1 - Accummulation, Stage 2 - Advancing, Stage 3 - Distribution,

Stage 4 - Declining.

My favourite long trade setup: CLASS A + Stage 2.

My favourite short trade setup: CLASS C + Stage 4.

Long trade always happens in the BUY ZONE (1/4) and Potential Profit Taking is in SELL ZONE (4/4)

When go long, make sure that the channel is pointing up and the angle of ascending is at least 45% above,

the steeper the slope, the more aggressive is the Market to move the price higher. Likewise do the

opposite for Short trade.

There is no certainty in trading, we are dealing with probability, as such remember to plan CUT LOSS.

Saturday, April 23, 2011

Another Powerful Display of the Black Diamond, Look out for "No Demand" on the next 2 bars

Once Black Diamond appears, look out for the next two bars to see if there is no demand. If no demand

bar is detected (upbar with volume less than the last two transaction volume), it qualifies as Short Sell Candidate.

Past posting on similar topics as follow: Read if you have missed it earlier.

http://volume-price-spread-for-metastock.blogspot.com/2011/03/another-demonstration-of-newly.html

http://volume-price-spread-for-metastock.blogspot.com/2011/02/new-developed-indicator-that-inform-you.html

http://volume-price-spread-for-metastock.blogspot.com/2011/03/new-scanner-picks-up-stock-for-shorting.html

Using the Same Trading System on US Stocks - Portfolio update on 210411

Reshuffle the portfolio with some stocks such as "BBT" and "POM" will be taken out while

4 additional stocks that trigger "Go Long", Blue Diamond System have been added.

(This is a trial account from http://www.updown.com/ where I test and finetune the indicators and scanners

programming).

Thursday, April 21, 2011

210411 - Took a trade on this stock after posted it at http://chartfreely-sg.blogspot.com

Reference chart posted on 20/04, http://chartfreely-sg.blogspot.com/2011/04/china-xlx-fertiliser-weekly-chart.html

Thursday, April 14, 2011

Wednesday, April 6, 2011

Another Example on How I use Stage Analysis to decide to buy or short sell?

By staging a stock into each cycle whether it is up, sideway or down. You can immediately know how to trade off this stock at the lowest risk.

But how? Simple, looking at the chart now, will you short a stock at Stage 2? Will you buy a stock at

Stage 4? So does that solve your problem by not getting you into the wrong stage of trading.

Let say that you bought a stock at Stage 2 and price is too far out from the moving average (black line),

don't worry, most mistakes made at Stage 2 will be forgiven. Why? price will pull back to the moving average to consolidate strength for the next higher upmove above the previous peak that you have entered.

As long as price continues to track along Stage 2 trend channel, don't worry pal.

If for me to trade any stock, it will be very near to the channel base with progressive volume coming

in to support the price trend. Buy when the stock is quietly moving up the channel. If it appears in the

Top Volume of the day, risk maybe getting high and I may not take a trade.

A sample of my classic Entry and Exit as shown in the chart below:

Notice: How the Propiertary Blue Diamond appeared along the base channel to trigger "Long

order" for me?

Tuesday, April 5, 2011

Why and When will I take Profits out from a Stock?

Due to the heavy workload in my current new Job as IT Presale Consultant, I just got it missed and took

a trade two days later on 23rd using my IPhone. Frankly speaking, I love to trade with Poems Mobile.

It is so handy and I can take a trade even when I am in the toilet, travelling to client's place. Once a trade is

transacted, I will immediately recieve an email to my inbox, what a great technology we have today?

If you are looking for a reliable remiser from Philip Securtiy, I can recommend my current broker who is responsive and man with integrity.(note, I have no referral fee at all. I have introduced at least 5 friends

who are new to trading to open an account with him). He will send his analysis often and I feel that it is

good for newbies.

Come back to the above chart, so I took a trade on 23rd March and I shared with friends around me through sms or whatsapp. The reply from most of them were "wa..so expensive stock and have gone up

alot already, don't think it will go up soon, better buy yang zi jiang, cosco or nol, cheaper leh".

Well, it really doesnt matter what the price of the stock is, what really matter is if the stock will move higher

from my entry level to make profits for me even it is expensive.

So I replied my friends " do you want to buy stock that is getting cheaper each day or getting more expensive each day to make a profit?" and the reply was "the stock has to be expensive after purchase inorder to make a profit" . HAHA.... Then I said, "In this case, then why want to look for stock that is getting cheaper now or moving down the channel? and the usual reply would be "oh, because it is more affordable and I can buy more lots instead."

Frankly speaking, this is what I have heard over and over again from any friends who do not trade well or make some decent profits over a period of time. Many of them are in the state of confusion because most

of them want to buy stock that is getting cheaper each day and hoping for profit one day.

For me, I love stock getting more and more expensive each day especially in STAGE 2 and CLASS A stock.. So what is ClASS A, B, C and Stage 1,2,3,4 then... Below is an extract from my ebook written in 2003 title "Personal Trading System" to share what is CLASS A and Stage 2.

If you have joined the SGtrader's Trading Group, you will be taught this vital skills to survive in the market.

Class “A” stock

- stock continues to trend higher after breakout. No known near term resistance.

- risk is low and reward is high as price just starts to move out from base.

- price is trending above 200MA (MA commonly used by fund managers)

- breakout volume must be at least twice the average and the spread is equally wide.

STAGE 2: Advancing Phase

- ideal stage to buy, stock swings out of its long term base, starts to trend higher.

- profitable breakout usually occurs with large volume. 200MA turns up shortly after

breakout provides confirmation of strength

breakout provides confirmation of strength

- investors buy stock on the initial breakout or on the last pullback towards the

breakout level. This is a 2nd chance to take advantage.

breakout level. This is a 2nd chance to take advantage.

So Come back to the chart again, when combine with Classification of Stock and Stage Analysis with my

propiertary trading system, it becomes clear to me if I am riding the right stock with the right stage to make

an income. Base on the last two trading days, expert indicators "lack of demand" triggered twice. When

cluster of indicators appear consecutively, it has to be respected with full attention.

So how am I going to handle this situation when my trading system is sounding that there is weakness in

the current uptrend? I respect and follow the order by setting yesterday's low as the trigger point for me

to exit and take profit. If tomorrow onwards, price starts to fall below 04/04 low $5.92, I will walk away happily with what I have made within 10 trading days. Don't grin over too little profit made, just take what the market give me. Nothing is for sure in the market, we are dealing with probability. Stay healthy and be happy.

Cheers

Sunday, April 3, 2011

Combining Stage Analysis, SGtrader's Channel Trading & Expert Indicators - High Probability of Success.

Stock Market goes through four stages of cycle, stage 1 - 4 with each stage plays an important part to

the type of trading strategy to use and take advantage of the stage. This teaching is made popular by

the type of trading strategy to use and take advantage of the stage. This teaching is made popular by

the author of " Secrets for Profiting from Bull and Bear" by Stan Weinsteins.

When I first came across this book, it was doubtful with the title which began with "Secrets". Many

authors like to use this strong word to attact readers to pickup their books and hopefully buy them.

authors like to use this strong word to attact readers to pickup their books and hopefully buy them.

Nevertheless, I picked up the book, scanned the front and back cover for more information and then

the contents. As I read the book, I immediately knew that this could be the book that could assist me to

break down the stock movement into stages and if I could use the right strategy for each stage, I should

be ok.

the contents. As I read the book, I immediately knew that this could be the book that could assist me to

break down the stock movement into stages and if I could use the right strategy for each stage, I should

be ok.

So I bought the book and treated it like a bible, I read and read each time when I had time until I

understood the author's intention.

understood the author's intention.

I started to employ stage analysis to the charts in 2003 and was able to detect each stage as the

Market unfolded. This is really an amazing skills to have. By staging the stock correctly, I am able to

identify the accummulation, advancing, distribution and declining stages without any difficulty. The

best of all, stage analysis prevents me to Sell Short a stock in Stage 2 Advancing Phase or Go Long

in Stage 4 Declining Phase. This knowledge has kept me out of trouble by knowing which stage to

apply the correct trading strategy.

Market unfolded. This is really an amazing skills to have. By staging the stock correctly, I am able to

identify the accummulation, advancing, distribution and declining stages without any difficulty. The

best of all, stage analysis prevents me to Sell Short a stock in Stage 2 Advancing Phase or Go Long

in Stage 4 Declining Phase. This knowledge has kept me out of trouble by knowing which stage to

apply the correct trading strategy.

Beside apply my own propiertary indicators and trend channel to a stock chart, I make use of stage

analysis as a qualifying criteria to pick up which stock to trade out of the hundreds. If I am planning for

analysis as a qualifying criteria to pick up which stock to trade out of the hundreds. If I am planning for

a "long trade", only stage 2 will be considered, if I am planning for "short sell", only stage 4 will be

considered.

considered.

With this method, I have less chance to make mistake trading in the wrong direction and improve my

odd of success.

odd of success.

Below is a sample chart on how I stage a stock for trade consideration.

Saturday, April 2, 2011

How the RTD Function in MSexcel work in Real Time Portfolio Management?

Good Day Traders

For those who have just joined the SGtrader's Trading Group, you should have recieved an email to where you can download a sample of my Real-Time Portfolio using MSexcel RTD function. It is simple to use and manage.

Think Simple. Dont complicate a simple task into complicated issue. Just like many traders who

like to have more than 4 TA indicators in their stock chart. Many a time, each indicator will contridicate

each other and it does more harm then help. I do not use any of them now after I start to learn to read bar by bar which is the only leading indcator you can think of. Others are just derivatives of price and volume.

Cheers

Friday, March 25, 2011

How to determine Risk & Reward for every trade?

Above is a usual trade setup uses by me to perform Risk to Reward analysis before I press the button to

buy or sell.

With a customized riskcalculator that I have programmed many years back, assisted me to determine

if the risk is worth to take or just let it go instead.

What make a good trader is nothing more than the tools he uses to trade the market. With simple

tool like this calculator, once can easily walk away from lousy deal,instead look for another stock

that presents better returns although there is no guarantee to win in trading. But we close the gap

up to make a good trade.

As you can see in this calculator, I have the cutloss level just beside the target level (near term resistance)

where I make this the 1st priority in any trading. Always determine where will be the cutloss, so that

you can easily obtain the risk and reward ratio at the end of the calculator. With this estimation of

the risk that you have to take inorder to recieve the rewards, you can easily make a quick decsion whether

to take the trade or just leave it along.

Many times, when we found a stock that is trading with excessive volume and has been trading higher for

past few days, we may have the urge to jump into the stock without analyzing chart on the possibly near

term resistance or support. With this risk calculator, you can easily enter the buy price (support level) and

sell price (near term resistance level) and cutloss (below recent support level). Once you have all these

data key in, you can check the risk to reward ratio if it is still a good trade.

Never rush to buy a stock that has been in the top volume for days. Nothing is free as this could be a trap

setup by the professionals to trick the herd to go long so that the professionals can transfer their holdings

to the weaker buyers. Once the transferring is done, the stock will continue to move higher for the next few days but without volume to support this upmove, so the stock start to tumble down like a stack of cards.

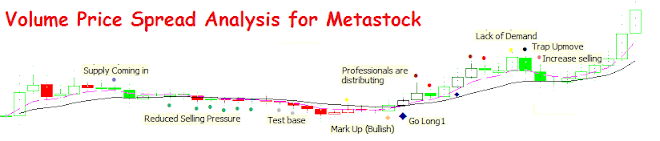

Dont be greedy, just be patience in trading. Always buy at channel base where the stock is quiet and unnotice by majority where there is sign of accummulation from the professionals. Such indicators in my system to determine this strength is as follow:

Test Base - professionals are probing the base, if the next bar shows successful test, the price will go higher

Reduced Selling Pressure - after a big sell off, market starts to cool off slowly and move sideway, reduced selling pressure is witnessed as any selling has been absorbed by the professionals so that they can stage an upmove in the near future when the catalyst for a bullrun is present.

No Supply - selling has reduced significant and if there is no selling, stock will move sideway or uptrend.

Markup - price is marked up to trick shortists to cover their shorts, usually a "V" up move.

Demand coming in - professionals are coming in to buy up with average to high transaction volume.

Bottom reversal - price reversal from bottom, forcing shortists to worry and cover shorts

Climatic action - heavy transaction volume at the lowest low but close higher near the day high, the professionals are finding worth in the stock and decide to absorb all selling and push price higher instead.

These are just some of the indicators that I have created by examing the demand and supply of the

market.

A good reference site to learn more about the price and volume action is the popular "tradeguider" video

from youtube. Where the professionals are telling the truth about the market.

Sunday, March 20, 2011

How to Swing Trade Effectively?

Many of the traders are unable to trade well or make unnecessary mistakes during hunches. If I tell

you that I do not watch the stock price every second, you may not believe it.

Staring at the real time price(bid & ask) each second can cause severe heart attack and lousy trades.

Imagine that you come across a stock in the top 20 volume and price is moving up. You decide to open

the real time time and sale to see each transaction done. Every uptick in price makes you excite and lure

in to the trade which you have not done any analysis before hand. So you bought it in the morning session and watched the screen until market close. You felt like a champion that you had picked a steal from the market and money should be attracted to you soon.

Wait, second half of the session opened and Futures markets were down. Suddenly the local bourne

started to take a turn and STI index went from +30 pts to -50, now you were caught as the stock that

you bought earlier started to pull back to it's open price and now you lost 5cts a share. How could this happen?

How could the market being superb positive in the morning, now turning negative in the last trading session?

so what should I do now? should I sell away the stock or wait for another day and hopefully the price would go back the bought price so that I could even out and exit.

What a emotion roller coaster? from winning to losing within a day? Must be bad luck.

Above is a typical scenerio experiences by many including me as well.

Is there a better way to trade and not to worry about daily volatility and able to sleep well each night?

Yes for me, from the above diagram. "Buy zone" is the area where I will go long base on price and volume

action to confirm a trade. Once in the long trade, as long as price is not below the "sell zone", I would

keep the stock and let the stock to wiggle its way up the channel.

So when I will start to seriously look at the stock? when it is in the upper channel, "sell zone", where I may decide to take profit due to confirmed weakness base of price and volume analysis.Or price has traded

below the "buy zone" and I would cut loss and wait for the next opportunity to re-enter or go for other stock

that is exhibiting strength to move higher in the "buy zone".

To summarize, when a stock is in either "Buy zone" or "Sell zone", will I be interested to check the chart to identify potential strength or weakness.

When stock is in the "Do Nothing Zone", basically I will let the price to meander along the channel and do not bother by its activity each day until the price comes to the extreme ends (buy or sell zone)

Tuesday, March 15, 2011

New Scanner Picks up Stock for Shorting!

A new scanner that is coded to scan for weakness two days earlier and get you to watch out for the next two days price action. When "lack of demand" or other expert indicators such as go short, supply coming in or

top reversal, this may be a golden opportunity to go short sell with high probability setup.

Below is the stock that is picked up by the scanner on 15/3/11 closing price.

Above is the weekly chart, looking where the new expert indicator appeared "Look for No Demand for Shorting", we need to wait for the next two weeks trading session to reveal possible weakness.

Indeed, after the expert indicator triggered a week earlier, subsequent week triggered "Lack of demand",

This week as long as price is closing below the 50% level of the previous bar "Lack of demand",

short sell is recommended.

Monday, March 14, 2011

Potential Stock for Shorting - Pick Up by Short Sell Scanner

Scanner picked up City Developments for shorting on 14/03/11.

If support at $10.80 is unable to hold price, expect further downside to retest the previous

base @$10.50

Friday, March 11, 2011

Combining Stage Analysis and Diamond Trading System Can Keep Out of Trouble

clear and clean understanding on how the Professionals activities are revealed to the masses

and how we can follow the footprints of the Smart Money and possibly trade alongside with

them. No matter how bullish or bearish, always guard your cutloss level.

Knowing the FOUR stages of stock cycle, can keep you out of trouble.

By identifying which stage is the stock now will keep you out of trouble. Such as never go long in stage 4.

Buying only happens on stage 2.

By charting the stock into four cycles, I can easily identify the cycle for long trade or short sell.

Cheers

Monday, March 7, 2011

Another demonstration of the newly created Indicator that provides excellent shorting opportunity

Previous blog post, I demonstrated how the new indicator "Looking for no demand for shorting" from the below post, if you miss it, click here >> http://volume-price-spread-for-metastock.blogspot.com/2011/02/new-developed-indicator-that-inform-you.html

Above is another stock that triggered the expert indicator sometimes back, the black diamond is

specifically used for this alert. You will see this often in the future. As you can see, after the black

diamond triggered,I had to wait for potential weakness on the next few bars to warrant a short sell. Immediately after the black diamond, we could see that the next alert was "Lack of Demand" and this confirmed the weakness. But shorting should be done only the next bar if it closed was below the

pivot level of the "Lack of Demand" bar. Indeed, as shown above, the next bar closed much lower

than the"Lack of Demand" bar and warrant a short sell. This is no coincidence, with a trading system

that alerts me on possible future event to look for, make trading fun and interesting to be.

Sunday, March 6, 2011

How to confirm a stock background weakness for Short Sell?

Temple Bar Investment Trust (LSE: TMPL) is a large British investment trust dedicated to investments in UK securities. Established in 1995, the company is a constituent of the FTSE 250 Index

1st check on Monthly Chart to have a bigger picture.

2nd Look at the Weekly Chart for sign of strength or weakness

lastly, look out for bearish indicators, confirm that Monthly, Weekly and Daily charts are telling

the same story that the stock is weak in the background. Look out for further weakness by observing possible expert indicators trigger sign of weakness alerts.

In the chart below, newly created expert indicator " Go Short if No Demand over next

2 bars" triggered, therefore look out for any sign of weak bar over the next 2 days. Indeed the next day,

"lack of demand indicator" was triggered and if the next bar(04/03/11) traded below the previous day's close then it could be a good short sell. Yes, it did and we can see that 04/03/11 closed below

the previous day's closed, it is a genuine short sell stock.

Wednesday, March 2, 2011

Diamond Trading System applies in all Financial Markets

Sometime back last July 2010, after I had programmed the first edition of Diamond Trading System, I decided to further finetune the indicators by looking for trial accounts in the net to test the system.

I spotted a few free trading platforms but many are too little in the credits offered. But I found http://www.updown.com/ where the site offers 1million dollar of credit to trade. So I decided to create

an account and use the trading platform to test my trading system.

I would subscribe to a data provider inorder to obtain USA EOD data and would run my Diamond

Scanner to pick stocks for analysis. Once a basket of 3-5 stocks were selected, I would enter the

orders for queue without waiting for the US Market to open for trade, and headed to bed.

The basket of stocks would have cut loss levels defined and when any of the stocks triggered the

cutloss, I would execute sell order to exit the stock before the US Market open.

This went on for months while I continued to finetune the trading system with more improvement

such as more indicators to reveal the activities of the professionals, and many more stock scanners

to pick Blue or Orange Diamond Stocks for the next trade.

I would constantly reviewed the portfolio and replaced weaker stocks with newly picked stocks.

Knowing that my Diamond trading system can work well not only in local SGX context but also

US Market, commodities, forex and foreign stock exchanges such as Hang Seng, ASX, Nikkei,

really thrilled me to continue to develop better technique to chart any stocks with clear definition

such as colored price bar, trend cluster just below volume and colored volume as well.

I used pivot point level as trigger to buy or cut loss stock on daily basis, drawing channel lines to

determine the major trend ahead. By segmenting the channel range into quarters, I can quickly

determine the near term resistance or support for the stock.

With bar by bar analysis, I am able to interpret the current underlying activities of the professionals to a certain degree of accuracy in very short term.

Monday, February 21, 2011

Saturday, February 19, 2011

When everybody is chasing higher price, who is selling then?

Years of trading have taught me not to chase stock which is heavily transacted with or without wide

price range. If the volume is extremely high says 2 - 5 times above the average volume. I would not

trade on that day, but I would choose to stay aside and watch the stock unfolds in the next few sessions.

If the stock continues to be bullish, i would expect price continues to go higher with substantial

volume but if price starts to fall below the pivot level, I would walk away and wait for the Blue

Diamond to trigger long trade.

Even though, we cannot forsee the possible run-up in the stock price in the near term.

A way to take advantage is to trade along with my propietarty indicator, "Go Long1" is able to

trigger long trade near the baseline where the price starts to move higher

from there. Usually the previous price bar is used as cutloss reference, and most of the time,

cutloss is seldom triggered even it could be just 2-5 cents away from the buy price.

The reason is simple, most of the indicators are coded taking future price into consideration

which means tomorrow conditions must be met so that the indicator will trigger today.

Most of the time when I trade, I never scan for home-run stock as we are not GOD to know.

Faithfully follow my Personal Diamond Trading System, I encounter many non eye-catching

stocks later turn into monster trades...So just work hard to make a good trade each time and

let the market decide where the stock price will be later and care less. The most important

thing I do after enter a trade is to watch the cutloss level like a hawk each day.

As long as the cutloss is not triggered, I am a winner to survive another day.

Cheers!

Friday, February 18, 2011

Why Majority of Traders tend to lose Money Chasing Explosive Price & Volume Day

Ok, I have some dollars to trade today and I am waiting for any stock that gives me bullish signal to

buy so that I can plug some money for coffee.

Oh, this stock has never been in the top 20 high volume list but today it has appeared with volume

exceeds 2 - 3 times normal daily volume.

Hmm, yesterday night, news reported that this company has bagged some new contracts worth xyz

million of dollars and today price starts to move up quickly with substantial volume after market open.

This stock looks so bullish, it must be my lucky day. I have been waiting for days and the time has

come for me to make some money.

Woo, the price has never traded with such a enormous gain of 25% price gain and extremely high

volume by late afternoon.

Ok, I have entered to queue to buy but it is still in the queue. Oh, market is going to close in an

hour's time and I need to run errand and may not have time to monitor the stock.

Ok, since the stock is moving higher with enormous volume, I think that it is ok to go along with

the tide. I am going to make some money this week, woo...I love this stock, hopefully it will run up

another 25% or more tomorrow and I can celebrate victory.

Ok, I cancel the previous queue and immediately buy at the ASK price.. Woo, I feel great after

transaction. I am going to make some money tomorrow for sure.. Ok, better inform my friend,

Alex, and let him know that this stock is a top performing today in Daily Top Volume and number

one spot.

Hmm, I am feeling like a champion. Can't wait to watch the market tomorrow again. What an

exciting day.

---------------------------------------------------

Above is the typical trader that trades stock on hunches and witness for yourself what happens

after the highly transaction day from the chart. I won't give you the answer, as the chart is clear.

Trading is never a simple game. It's the toughest game I ever play but I enjoy every single

moment.

Cheers

Sunday, February 13, 2011

Another Powerful Display of Blue Diamond Indicator detecting each turning point.

This is another demonstration on the Diamond Scanner which picks up stocks for further analysis every single day.

Inorder to trade well, I believe that we should not worry about not having stock to trade each day.

If a stock which we are holding is losing its upward momentum, it is best to protect the profits and

use the scanner to pick another potential stock to trade. No point holding on to a stock which is

exhibiting weakness and hoping that it will turn up in the future.

That is one of the reasons why I do not hang on to stock which shows weakness. Protecting profit or

know where to sell is as important as where to buy.

By taking profits on weakening stock and moving quickly to another stock picks up by the scanner proves

to be a nice way to compound earning again and again.

So in order to trade well, you need to have a Personal Trading System that includes the following:

1) A good Charting Software which allows personal coding of indicators and scanners

2) Stock Scanners that can pick up potential stocks for serious picking for income.

3) A strategy to cut loss and take profits base on what the market tell us.

4) Strong discipline to follow the system.

5) Nothing is free, when tips are from any sources, brokers or friends. Justify the claim from the chart

instead.6) Believe the chart, the professionals cannot lie to you as their footprints are caught in the transacted volume.

If you can decode the volume, you know how to master the market.

Inorder to track all activities of the professionals, I have created a trading system that alerts me as price moves forward each day. Most indicators today available in standard charting package are lagging in nature or are derivatives of price and volume.

Kelvin's Trading System is created purely by understanding the demand and supply of the market, using of

trend channel, trendlines to determine the probable trading range and seek to buy from the base of the channel and sell at the top of the channel. Many indicators require the Day + 1 (future day) to meet certain

criteria before an indicator alert will appear. This system seeks to decode the activity of the professionals

within a short time frame and ride the journey with the professionals.

Below is a nice chart on Streettrackers Gold, looking where the blue diamond (Go Long1) appeared

at the base of the channel each time, provides a very lucative trading position without fail.

With the help of the Diamond Scanner, I am able to study with great detail on the stock for trading

opportunity.

Friday, February 11, 2011

New Developed Indicator "Failed Test Bar" to determine Base Level Support Strength

This is a new indicator coded to detect failed base testing from the professionals.

Professionals are constantly probing market base so that they know they the particular stock

is ready to move up by flushing most of the sellers.

A successful test base would mean that the sellers may have given up and the selling power have

reduced significantly, this is usually detected by another expert indicator, "Reduced Selling Pressure".

So when test base is successful, usually we will expect price starts to move higher or sideway.

This indicator provides a quick overlook of what the professionals are doing and thereby providing me

with the ample time to react alongside with the professionals to take advantage of the market inefficient.

SGtrader

Email: failureisnotachoice@gmail.com

Youtube: SGtrader1

Sharejunction.com

Name: SGtrader

Facebook.com

Name: Smart Trader

Monday, January 24, 2011

Powerful Scanner picked up CapitalMallAsia For SHORT SELL on 24th Jan

Good Day Trader

My scanner picked up CapitalMallAsia for short sell candidate. Two expert indicators appeared concurrently

denoting bearishness in the stock.

Further analysis showed that there is potential for the price to go lower towards the targeted level as

marked on the chart. Here we are dealing with probability and no certainty, therefore whether

Long or Short order.

We must protect ourselves against unexpected outcome by setting cutloss level by all mean.

Below is the chart that I have analyzed with expert indicators and trendlines.

Wishing everyone a Profitable 2011 & Happy New Year!

My scanner picked up CapitalMallAsia for short sell candidate. Two expert indicators appeared concurrently

denoting bearishness in the stock.

Further analysis showed that there is potential for the price to go lower towards the targeted level as

marked on the chart. Here we are dealing with probability and no certainty, therefore whether

Long or Short order.

We must protect ourselves against unexpected outcome by setting cutloss level by all mean.

Below is the chart that I have analyzed with expert indicators and trendlines.

Wishing everyone a Profitable 2011 & Happy New Year!

Personal blogsites:

http://chartfreely-sg.blogspot.com/

http://chartfreely.wordpress.com/

http://volume-price-spread-for-metastock.blogspot.com/

http://chartfreely-sg.blogspot.com/

http://chartfreely.wordpress.com/

http://volume-price-spread-for-metastock.blogspot.com/

Tuesday, January 4, 2011

Learn and Excel Together, Great Questions by a Reader.

Thanks bro for your questions, hope I have answered your questions thoroughly.

-------------------------------------------------------------------------------------

SGtrader says:

The folloing replies represent my opinion and does not represent the masses

or constitue to any buy or sell advice from me. Solely for educational purpose.

Don't be too serious.

We are solely responsible for our trading activity in the market, when in doubt,

please consult your financial advisor for more assistance.

-------------------------------------------------------------------------------------

SGtrader says:

The folloing replies represent my opinion and does not represent the masses

or constitue to any buy or sell advice from me. Solely for educational purpose.

Don't be too serious.

We are solely responsible for our trading activity in the market, when in doubt,

please consult your financial advisor for more assistance.

Cheers

----------------------------------------------------------------------------------------------

What is usually the signal for a buy?

1. When selling pressure decreased, low supply on sell side more on buy side.

Price near support or @ support range.

What is usually the signal for a buy?

1. When selling pressure decreased, low supply on sell side more on buy side.

Price near support or @ support range.

When selling pressure decreases, usually the sellers have already sold most of their inventories.

Price will continue to go lower due to momentum but soon price will start to move sideway to wait

for the next event to come. The sideway movement can last as long as the market decides.

Price will continue to go lower due to momentum but soon price will start to move sideway to wait

for the next event to come. The sideway movement can last as long as the market decides.

Until the next major events occur, it will continue to stay low. Base break out usually happens much

earlier then analysts coverage or news. This is becoz in most cases, many others related to the listed

company would have already knew the good news ahead and plan their purchases much earlier awaiting for

the news to break out to the public. This is usually detected by the unusual high transaction activities

when the stock is in sideway market but still within the trading range. This is sign of early accumulation

by the known persons. Take note: (This is my wild assumption and may not be true as Insider trading is illegal.

Read at your own risk.)

earlier then analysts coverage or news. This is becoz in most cases, many others related to the listed

company would have already knew the good news ahead and plan their purchases much earlier awaiting for

the news to break out to the public. This is usually detected by the unusual high transaction activities

when the stock is in sideway market but still within the trading range. This is sign of early accumulation

by the known persons. Take note: (This is my wild assumption and may not be true as Insider trading is illegal.

Read at your own risk.)

My system seeks to reveal this type of activity as it evolves…So that I can always position myself together

with them.Impt thing is to always watch your cutloss level no matter what happens…We are dealing with

probability in all cases.

with them.Impt thing is to always watch your cutloss level no matter what happens…We are dealing with

probability in all cases.

2. Good fundermentals

I don’t use fundamental analysis..I have seemed many lousy stocks become valuable after

massive speculation by pros..I also see cash rich company kana punished like nothing, there

is no logic at all. E.g Wilmar International

massive speculation by pros..I also see cash rich company kana punished like nothing, there

is no logic at all. E.g Wilmar International

Is wilmar fundamental weak after getting into property biz? No, still cash rich.

So why the stock is beaten down so much, due to fear and greed.

This sell down is seemed by me as a manipulated activities to cause many average traders to

unload their stocksto the pros who are actually accumulating but their activities are trying to

show that they are dumping.

unload their stocksto the pros who are actually accumulating but their activities are trying to

show that they are dumping.

Pros are known to play both sides of the market. They dump in the morning to create fear

and buy back cheaper at mkt close.

and buy back cheaper at mkt close.

If you follow my blog, you will see what I see..

http://www.sharejunction.com/sharejunction/listMessage.htm?topicId=9386&searchString=&msgbdName=Others&topicTitle=Are the Professionals ready to move

Wilmar UP?

Wilmar UP?

3. How do you really tell whether a stock is poised for a jump, by your expert

indicator.

If you know how to measure market expansion and contraction and compare to the stock that you are

analyzing, you will be able to see that the stock is now outperforming or underperforming the index.

I choose to pick stocks that outperform STI and it must be in stage 2 meaning I pick stock that is going

higher and higher and I love to buy higher price from the sellers. After all, this is the only way for price to

go higher if you understand bid and ask.

analyzing, you will be able to see that the stock is now outperforming or underperforming the index.

I choose to pick stocks that outperform STI and it must be in stage 2 meaning I pick stock that is going

higher and higher and I love to buy higher price from the sellers. After all, this is the only way for price to

go higher if you understand bid and ask.

Please correct me if im wrong, i only know the tip of the iceberg.

Usually i look at the normal MACD, RSI, STO. I feel those are really not trustable

and its really only the surface and lagging.

I had used those common indicators for 3yrs and I also joined TASS society and took the market

technican exam. It’s take expert to know how to combine those Indicators and many will not reveal

much in their bootcamp. Using those indicators, you must be good at spotting divergence and

convergence.

technican exam. It’s take expert to know how to combine those Indicators and many will not reveal

much in their bootcamp. Using those indicators, you must be good at spotting divergence and

convergence.

Many times, you will be left indecisive when the indicators are floating in the air..e.g. when macd

is widely apart from the signal line. The call for sell is to wait for both MACD and signal lines to cross

over. But by then, most profits are gone or worse if it goes under your buy price.

is widely apart from the signal line. The call for sell is to wait for both MACD and signal lines to cross

over. But by then, most profits are gone or worse if it goes under your buy price.

I have tested my system again all past indicators that I use… The most important of all is that those

indicators cant ride a trend too long. Cross over now and then giving the signal to buy or sell. meaning

you are going to make your brokerage super-rich by trading excessively.

indicators cant ride a trend too long. Cross over now and then giving the signal to buy or sell. meaning

you are going to make your brokerage super-rich by trading excessively.

This system of mine help me to ride a trend up to a max of 3max which is long term to me. It will filter

short term noises and I am above to achieve very good % of returns. Just as example. If you use daily

chart to trade and how many times will the price be cutting the 13MA.

short term noises and I am above to achieve very good % of returns. Just as example. If you use daily

chart to trade and how many times will the price be cutting the 13MA.

What if I used 13MA in weekly chart to trade, how far can the price goes before triggering a sell signal?

My system looks into daily chart vulnerability and smoothen it with weekly chart.

My system looks into daily chart vulnerability and smoothen it with weekly chart.

I read "Way of the turtle" and i feel its a fantastic book where traders learnt to trade.

They used trend trading and also bought in around when close>20d ma.

I also compare with turtle style of trading. This system is much closer to what I am using now

but turtle triggers too much transaction in a uptrend.

but turtle triggers too much transaction in a uptrend.

For a retail trader, getting to trade in and out of the market too frequently is going to kill your capital.

My system will help me ride a trend until weakness is found.

My system will help me ride a trend until weakness is found.

See below chart on how I usually trade a stock. As below, I bought at channel low where two bullish

signals were picked by my combine scanner (reduced

signals were picked by my combine scanner (reduced

Selling pressure + uptrend) then I sold when the price started to come into the channel, I could had

sold on the 1st weakness indicator “Trap upmove”

sold on the 1st weakness indicator “Trap upmove”

But decided to give the stock some more room to move. At the end, it still fell and I exited with 39% returns in a short period.

If you compare my chart above with turtle indicator applied below, check the turtle indicators on the chart.

From my original chart, you can see the the price bars were green until the day I sold whereas for the turtle below, You could see some sell stop signal and red price bar.. This may cause worry to traders who could have exited due to profit protect too early before the trend becomes mature.

It would be appreciative if you would share some of your long learnt knowledge.

Thanks,

Cheers.

Thanks,

Cheers.

Subscribe to:

Posts (Atom)