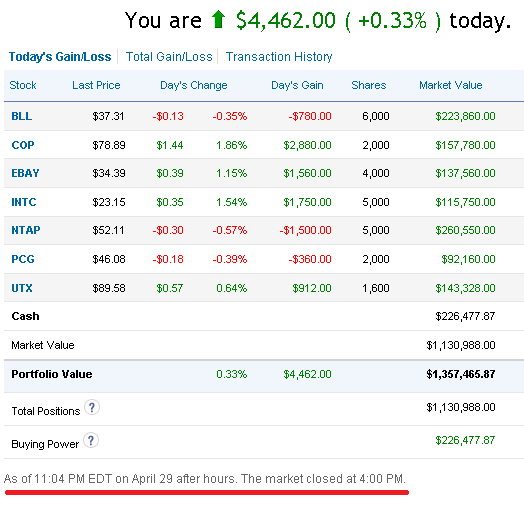

Sometime back last July 2010, after I had programmed the first edition of Diamond Trading System, I decided to further finetune the indicators by looking for trial accounts in the net to test the system.

I spotted a few free trading platforms but many are too little in the credits offered. But I found

http://www.updown.com/ where the site offers 1million dollar of credit to trade. So I decided to create

an account and use the trading platform to test my trading system.

I would subscribe to a data provider inorder to obtain USA EOD data and would run my Diamond

Scanner to pick stocks for analysis. Once a basket of 3-5 stocks were selected, I would enter the

orders for queue without waiting for the US Market to open for trade, and headed to bed.

The basket of stocks would have cut loss levels defined and when any of the stocks triggered the

cutloss, I would execute sell order to exit the stock before the US Market open.

This went on for months while I continued to finetune the trading system with more improvement

such as more indicators to reveal the activities of the professionals, and many more stock scanners

to pick Blue or Orange Diamond Stocks for the next trade.

I would constantly reviewed the portfolio and replaced weaker stocks with newly picked stocks.

Knowing that my Diamond trading system can work well not only in local SGX context but also

US Market, commodities, forex and foreign stock exchanges such as Hang Seng, ASX, Nikkei,

really thrilled me to continue to develop better technique to chart any stocks with clear definition

such as colored price bar, trend cluster just below volume and colored volume as well.

I used pivot point level as trigger to buy or cut loss stock on daily basis, drawing channel lines to

determine the major trend ahead. By segmenting the channel range into quarters, I can quickly

determine the near term resistance or support for the stock.

With bar by bar analysis, I am able to interpret the current underlying activities of the professionals to a certain degree of accuracy in very short term.