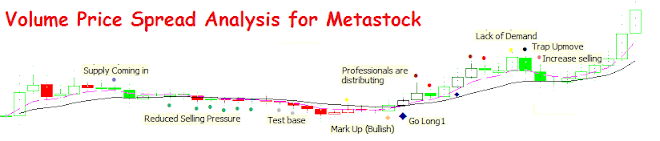

Above chart showed the well defined support and resistance levels.

Above showed that each bar is marked with a point number for my reference

when trying to explain the rational behind the scene.

To start off here, this is my personal view and it's ok that readers may not agree

or have their own explanations. This is fine for everyone as there are thousands

of methods to decode the market as your own experiences.

Below is my explanation and it is solely for education purpose only. Don't be too

serious with me, better get serious with your own financial business.

Refer to the chart for point 0 - A

Point (0)

Sellers dominated both of the sessions and at the end of the market day, buyers came

in and bought into the selling spree. That was the reason for the tail on both of the bars.

This buying does not mean that the pros are ready to move up the stock price as they

will accummulate at different intervals until the timing is right to move price higher.

This can usually be spotted by my indicators such as Test Base, Reduced Selling

Pressure, Markup Bullish, Bottom Reversal, No Supply.

.Point (1)

The reason for this bar to be positive because the previous two sessions contained

buying activities at the end of the day.This positve up bar was without substantial

volume to support upside.

Point (2)

Due to the previous day upbar was without much supported volume to sustain

the upside. Expert indicator detected "Lack of Demand" from the professionals.

The recent base level hd to be retest again.

Point (3)

Notice that this was a down bar which closed lower than the previous bar

but the volume was significantly lesser which triggered my expert "Reduced

Selling Pressure" meant that there were selling but had cooled off alot.

Point (4)

Look at price opened at the previous day's low level and at the end of the

session to close at day high with low volume and triggered "Reduced Selling

Pressure". This was the definitely tell-tale sign that the base had been formed

and sellers were not motivated anymore and expect price to either more sideway

or higher from now.

Point (5)

With the previous day confirming the base, today, price was purposely marked

up to flush out any hidden sellers. Although it was a positive upbar but the

volume was still below average level. Some sellers appeared, this was witnessed

by the closed price which did not close at day's high and price was still able to

hold above 50% pivot level as the sellers were not so powerful.

Point (6)

The previous bar was now a clear signal that the sellers were weak and unable to

punch down the price.Buyers were motivated and moved price quickly up with

substantial volume to close near day's high. Now, the bulls took charge.

Point (7)

The gapped up in price attracted profit taking. Both buyers and sellers were

motivated to make their firm ground. The buyers were trying to support the

selling pressure.

Both sides of traders fought for their rights to control the situation.

At the end, the sellers were able to create some injuries but werent life threatening.

Price still closed positive.

Point (8)

After a good fight, both sides of traders took a break to recover and consolidate position.

Point (9)

Today, the price opened lower then the last two days but was able to close at the

end of the day's high.This was clearly a sign that the sellers were badly wounded

and still in pain to whack a war again. But that wasn't meant that the buyers were

in upper hand, the buyers had won the battle but with below average activity level (volume)

which was a sign of concern on how long could this activity be supported.

Point (A)

Today, price closed positive and near 50% off its day high denoting that the

sellers are well and back again.

Conclusion:

In the near term, we could be experiencing sideway trading from this stock

until one side becomes clearly dominant.

Personal opinion, there are still good upside for Osim until 1st week of February.

The very important is don't be stubborn with own's view, stay vigilant

and let the market tells you what to do next. We can be very positive

on a stock but without a contingency plan of escape when market

suddenly turns south. We could be trapped with a home-run stock which

now becomes a liability.

When I trade a stock, I am more concerned about the risk that I would take

and watch that level closely. I may have a target projection but I am not

god to know if it will happen. Therefore, as long as each trading day that

the risk level to cut loss is not triggered, I will feel safe to survive another

day with price continues to move northward. When it's time comes to trigger

the risk level, exit graciously and be happy with what you have made.

Move onto another stock and repeat the transaction (buy, sell, cutloss) again.

Cheers