(A stock from KLSE, Malaysia)

(A stock from Singapore)

Woo, this is one of the many combinations that my Powerful Stock Scanner can pick up.

At first, price started to pull back towards moving average line and broke down. Falling price

was halted by "buying-in" from the Professionals and this was automatically alerted with a symbol

below the price bar.

Immediately after the price was supported (Climatic Action), Professionals continued to move price

higher. Price closed near the day high denoting enthusiasm to move higher the next day.

The Professionals aggressively accummulating the stock was denoted with a Blue Diamond symbol.

This was clearly illustrated again in the Mid-April and Early-June.

In many cases where Blue Diamond appears, price will immediately move higher away from the cutloss trigger set from previous day pivot level. So if the cutloss level is not triggered, continue to hold the stock and

adjust the cutloss level as price moves higher to protect the profits.

Do not be greedy, be happy to exit the trade if the profit protect level is triggered.

Use the scanner to pick the next potential stock for such a combination again in any stock exchanges.

Next posting, I will show Power Strategy #2 - Testing Base + Go Long Combination.

This is where the Professionals will probe the stock price to see if there is anymore sellers before

launching a delibrate pushing up of the price quickly.

Catch up with you again, bye.

Disclaimers: - No communication should be considered as financial or trading advice. - All information in this lecture/course/seminar are intended and solely for educational purpose only. - They do not constitute investment advice in any manner whatsoever or have any regard to the specific investment objectives, financial situation or individual needs of any particular persons receiving them. - Examples are used for illustrative purposes only and do not constitute investment advice.

Monday, October 18, 2010

Thursday, October 14, 2010

14th Oct - Sold off the remaining 50% of Golden Agri Shares. Found Weakness!

As expected, today's traded volume is much lower than yesterday massive volume as such

I watched the price bar closely.

As compared to yesterday's price range (high - low), today's price range is much narrow due to

the fact that there are still potential sellers where the demand is met by strong supply therefore

the price is locked within a tight trading range.

The weakness is confirmed when price closed at day low with high volume. If the Professionals

are interested in higher price, we should be expecting further upside today but this is not the case.

For now, I am expecting price to find support level near to yesterday's pivot level @$0.64 before

testing the near term price target of $0.72 level in weeks ahead.

Just be happy with what I harvested, move on to the next profitable catch using Diamond Scanner again.

Good Luck and Many Profitable Trades ahead!

Wednesday, October 13, 2010

Sample 10: Will price continue to trade higher from now?

Hi, if you have followed my sample charts from the beginning, you should not miss Sample 5 chart analysis on Golden Agriculture Resources on 29th September 2010 where I spotted three weeks of reduced selling pressure and commented that there is a possibility the price may rebounce soon.

Indeed two weeks later, 13th October 2010. Massive price movement today and this is no coincidence at all. By Mastering the art of intrepreting Demand and Supply in the Market, I am able to predict what the

SMART MONEY activities thereby taking advantage of the situation.

Interesting, I would usually exit all or partial during a massive bull run day. I did it again today by selling

50% of my holding to secure a nice pot of profits on the table and leaving the rest of 50% soldiers to fight through the upper channel wall (known resistance level).

After the Market closed at 17:05, I re-evaluate the stock to make some assumptions for tomorrow's session.

How I know that the bull run will continue tomorrow or fade out completely by tomorrow?

The answer lies in the today's transacted price and volume.

From the chart, price has just closed near the upper channel line which is $0.655. Breaking out of

this channel by tomorrow will be bullish as the upper channel line can become the new support level

for the price to propel further northward.

What if price really pull back tomorrow, what will I do next?

In my Personal Trading System, I utilize the Pivot Point for cut loss or profit protect strategy..

Base on today's closing, the pivot point is $0.63667. Therefore my profit protect level will be

set as $0.635 for tomorrow session. If the stock is subjected to massive distribution by tomorrow,

I will be out of the game at $0.635, generating 6.5cents of profits on 50% holding.

Another scenerio could be today's volume is not sustainable, therefore I expect the tomorrow volume

to be significantly lower and inorder to know if price will continue to go northward, I hope to see a small

negative price bar closes within the body of today's bar. See sample below.

This sample shows that after a massive upside the previous day, everyone will be wondering if the price

will continue to head higher or subject to profit taking.

When price pulls back with much reduced volume, this will show that "Yes" there maybe some selling pressure but the pressure has reduced significantly because the closed price is not lower than the low of the massive upday. This is a bullish sign and may mean that the Professionals may want to move the stock price higher very soon and they are just taking a short break.

So this is my way again, let's see what happens tomorrow then?

Anyway, the stock price is now in the upper channel level denoted as Sell Zone (Above the dotted red line).

It's time for harvesting.

Being GREEDY in the market is the Sure way to lose BIG.

Indeed two weeks later, 13th October 2010. Massive price movement today and this is no coincidence at all. By Mastering the art of intrepreting Demand and Supply in the Market, I am able to predict what the

SMART MONEY activities thereby taking advantage of the situation.

Interesting, I would usually exit all or partial during a massive bull run day. I did it again today by selling

50% of my holding to secure a nice pot of profits on the table and leaving the rest of 50% soldiers to fight through the upper channel wall (known resistance level).

After the Market closed at 17:05, I re-evaluate the stock to make some assumptions for tomorrow's session.

How I know that the bull run will continue tomorrow or fade out completely by tomorrow?

The answer lies in the today's transacted price and volume.

From the chart, price has just closed near the upper channel line which is $0.655. Breaking out of

this channel by tomorrow will be bullish as the upper channel line can become the new support level

for the price to propel further northward.

What if price really pull back tomorrow, what will I do next?

In my Personal Trading System, I utilize the Pivot Point for cut loss or profit protect strategy..

Base on today's closing, the pivot point is $0.63667. Therefore my profit protect level will be

set as $0.635 for tomorrow session. If the stock is subjected to massive distribution by tomorrow,

I will be out of the game at $0.635, generating 6.5cents of profits on 50% holding.

Another scenerio could be today's volume is not sustainable, therefore I expect the tomorrow volume

to be significantly lower and inorder to know if price will continue to go northward, I hope to see a small

negative price bar closes within the body of today's bar. See sample below.

This sample shows that after a massive upside the previous day, everyone will be wondering if the price

will continue to head higher or subject to profit taking.

When price pulls back with much reduced volume, this will show that "Yes" there maybe some selling pressure but the pressure has reduced significantly because the closed price is not lower than the low of the massive upday. This is a bullish sign and may mean that the Professionals may want to move the stock price higher very soon and they are just taking a short break.

So this is my way again, let's see what happens tomorrow then?

Anyway, the stock price is now in the upper channel level denoted as Sell Zone (Above the dotted red line).

It's time for harvesting.

Being GREEDY in the market is the Sure way to lose BIG.

Tuesday, October 12, 2010

Sample 9: Excessive Volume Upbar may not be a good thing

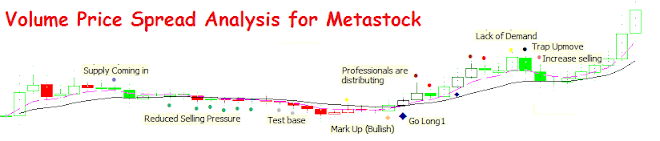

Looking at the two marked areas with extremely high volume with positive closed. But

what happened the next day? Price began to tumble instead of moving higher. This

is really confusing as why price fell after a solid upday on the previous day.

This is clearly detected by my Expert Indicator which showed the message "Professionals are

distributing". But why distributing and not accummulating more to the upside instead.

The reason that I can imagine is that the Professionals with huge book orders are unable to

unload all the shares at in a quiet market place. They have bought much earlier at a discounted

price and waited for the right time to unload the inventory to make a pile.

The only way to unload the massive inventory will be during a bullish market day where there are

more demands. This will be the time where the Professionals will be able to unload to the demand side of

the market. After unloading, there are no reason for the stock to go higher and this can be verified

by the next trading day volume which is usually average to low volume. Price will start to move lower

to find its next support level where the Professionals will enter again to accummulate the base which

later become the FULCRUM for the price to move higher again.

This is how I interpret the market, this is my way!

Thanks for reading!

Sunday, October 10, 2010

08th October 2010 - Exclusive Analysis on Taiwan Stocks

Just happen that a taiwanese friend has asked for my opinion of some of his stock picks.

I decided to use my Diamond Scanner to pick a few stock for him beside analyzing his

self-picked stocks.

My Scanner report as below:

These are the stocks that meet the criteria for Long Order. I would usually check each of the stock chart for better understanding if there is trading opportunity.

For example, I check on the 1st stock which is Kinpo Electronics chart and plotted line studies on it.

My Study suggests that there is a good probability to take this trade as price is trending along the lower

channel and within the "Buy Zone". It may take a few more days for the price to build strength to trade

above the dotted blue lines which is the safety zone for price to head higher towards the "Sell Zone" for harvesting. Till then,

Good Luck and Happy Profitable Trading Ahead!

I decided to use my Diamond Scanner to pick a few stock for him beside analyzing his

self-picked stocks.

My Scanner report as below:

These are the stocks that meet the criteria for Long Order. I would usually check each of the stock chart for better understanding if there is trading opportunity.

For example, I check on the 1st stock which is Kinpo Electronics chart and plotted line studies on it.

My Study suggests that there is a good probability to take this trade as price is trending along the lower

channel and within the "Buy Zone". It may take a few more days for the price to build strength to trade

above the dotted blue lines which is the safety zone for price to head higher towards the "Sell Zone" for harvesting. Till then,

Good Luck and Happy Profitable Trading Ahead!

Tuesday, October 5, 2010

Using RTD Function in MSExcel for my Portfolio Management

Using simple spreadsheet to manage my Profit & Loss for each transaction.

Most of the fields are automated except for buy price, sell price, lot size and cut loss price.

Monday, October 4, 2010

Sample 8: Simple Strategy to Cut Loss and Let Profit Runs. I did this my WAY!

There are many risk management books that tell you how to cut loss and take profit when necessary.

The most important of all, the strategy must suit your own Personal Trading System.

Most of the trading books are catered for very short term trading such as Futures and Forex as

such applying the same methodology to slower Stock Market maybe backfired as the cutloss is

either too close or too far away.

The key issue here is when the cutloss level is triggered, will you be brave to cut away the losses

and endure temporary pain instead of ending up with losing position that deteriorate over the time and

most intense pain. I always believe "First lost, the best lost".

The strategy that outline here is solely for my style and may not be suitable for you, if you like too, you

may try this strategy too.

So what is my intention on this risk Management?

After analyzing multiple timeframes, monthly, weekly & daily chart of a stock which is picked up by my

proprietary diamond scanner. I will have an good idea where will be the next resistance level.

Therefore if this trade is taken, I am expecting the price to trade higher from the buy price and if that

does not happen, I have this strategy to follow:

Sell if closed price < 50% Previous Trading Day Pivot Point(Transacted Day - 1) or

If Price < Buy Price within the next 10 days.

Ok, why "Sell if closed Price < 50% Previous Trading Day Pivot Point"

The reason is simple, this method is used only during Initial Buy Order so that

price will not close below Previous Day Pivot Point. If it does, then expect price to fall further

until a base is formed or supported. If price does not trigger this cutloss, price should be

moving away from the cutloss level. This provide the 1st assurance that I can break even soon.

Next, If "Price < Buy Price within the next 10 days = Cut Loss"

If price does not trigger the previous day Pivot Point, price should be heading north. Giving

a short time frame of 2 weeks to see there is internal weakness and price cannot sustain the

upside and start to fall and trigger the cut loss.

If both of the risk management are not triggered after the 10th day, I will utilize the weekly chart

as the base for holding on the winning stock while using the daily chart to spot potential weakness

in the trend.

Most of the time, while the weekly chart is looking positive and price is pulling back to support

level in daily chart. There is no cause of alarm.

The time to stay alert and take profit will be when the weekly chart and daily chart are showing

trend weaknesses or expert indicators that appear in the upper channel level such as "Trap Upmove", " Higher Price is stopped", "Top Reversal", "End of Up Market", "Lack of Demand", "Bearish" or

"Increased Selling Activity".

What goes up like a rocket, will do the same as it comes down. So do not buy "HOPE" in the trading

arena, it will be too painful and expensive to bear.

When the both the Cut Loss Strategy have not been triggered, I will revert to weekly chart as shown

below to allow more room for price to move further up. While using daily chart to detect early

sign of weakness.

As I said before, this is My Way. You may have a better way to do it.

Important, we just want to take some profit from the Market each time, no matter what

kind of methods we adore.

Best Wishes and Making Profitable Trading Ahead.

Subscribe to:

Posts (Atom)