Disclaimers: - No communication should be considered as financial or trading advice. - All information in this lecture/course/seminar are intended and solely for educational purpose only. - They do not constitute investment advice in any manner whatsoever or have any regard to the specific investment objectives, financial situation or individual needs of any particular persons receiving them. - Examples are used for illustrative purposes only and do not constitute investment advice.

Monday, March 14, 2011

Potential Stock for Shorting - Pick Up by Short Sell Scanner

Scanner picked up City Developments for shorting on 14/03/11.

If support at $10.80 is unable to hold price, expect further downside to retest the previous

base @$10.50

Friday, March 11, 2011

Combining Stage Analysis and Diamond Trading System Can Keep Out of Trouble

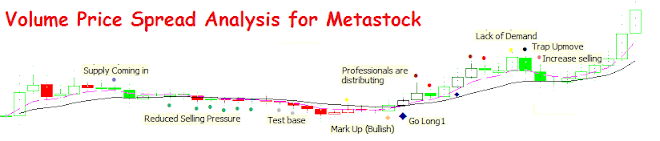

clear and clean understanding on how the Professionals activities are revealed to the masses

and how we can follow the footprints of the Smart Money and possibly trade alongside with

them. No matter how bullish or bearish, always guard your cutloss level.

Knowing the FOUR stages of stock cycle, can keep you out of trouble.

By identifying which stage is the stock now will keep you out of trouble. Such as never go long in stage 4.

Buying only happens on stage 2.

By charting the stock into four cycles, I can easily identify the cycle for long trade or short sell.

Cheers

Monday, March 7, 2011

Another demonstration of the newly created Indicator that provides excellent shorting opportunity

Previous blog post, I demonstrated how the new indicator "Looking for no demand for shorting" from the below post, if you miss it, click here >> http://volume-price-spread-for-metastock.blogspot.com/2011/02/new-developed-indicator-that-inform-you.html

Above is another stock that triggered the expert indicator sometimes back, the black diamond is

specifically used for this alert. You will see this often in the future. As you can see, after the black

diamond triggered,I had to wait for potential weakness on the next few bars to warrant a short sell. Immediately after the black diamond, we could see that the next alert was "Lack of Demand" and this confirmed the weakness. But shorting should be done only the next bar if it closed was below the

pivot level of the "Lack of Demand" bar. Indeed, as shown above, the next bar closed much lower

than the"Lack of Demand" bar and warrant a short sell. This is no coincidence, with a trading system

that alerts me on possible future event to look for, make trading fun and interesting to be.

Sunday, March 6, 2011

How to confirm a stock background weakness for Short Sell?

Temple Bar Investment Trust (LSE: TMPL) is a large British investment trust dedicated to investments in UK securities. Established in 1995, the company is a constituent of the FTSE 250 Index

1st check on Monthly Chart to have a bigger picture.

2nd Look at the Weekly Chart for sign of strength or weakness

lastly, look out for bearish indicators, confirm that Monthly, Weekly and Daily charts are telling

the same story that the stock is weak in the background. Look out for further weakness by observing possible expert indicators trigger sign of weakness alerts.

In the chart below, newly created expert indicator " Go Short if No Demand over next

2 bars" triggered, therefore look out for any sign of weak bar over the next 2 days. Indeed the next day,

"lack of demand indicator" was triggered and if the next bar(04/03/11) traded below the previous day's close then it could be a good short sell. Yes, it did and we can see that 04/03/11 closed below

the previous day's closed, it is a genuine short sell stock.

Wednesday, March 2, 2011

Diamond Trading System applies in all Financial Markets

Sometime back last July 2010, after I had programmed the first edition of Diamond Trading System, I decided to further finetune the indicators by looking for trial accounts in the net to test the system.

I spotted a few free trading platforms but many are too little in the credits offered. But I found http://www.updown.com/ where the site offers 1million dollar of credit to trade. So I decided to create

an account and use the trading platform to test my trading system.

I would subscribe to a data provider inorder to obtain USA EOD data and would run my Diamond

Scanner to pick stocks for analysis. Once a basket of 3-5 stocks were selected, I would enter the

orders for queue without waiting for the US Market to open for trade, and headed to bed.

The basket of stocks would have cut loss levels defined and when any of the stocks triggered the

cutloss, I would execute sell order to exit the stock before the US Market open.

This went on for months while I continued to finetune the trading system with more improvement

such as more indicators to reveal the activities of the professionals, and many more stock scanners

to pick Blue or Orange Diamond Stocks for the next trade.

I would constantly reviewed the portfolio and replaced weaker stocks with newly picked stocks.

Knowing that my Diamond trading system can work well not only in local SGX context but also

US Market, commodities, forex and foreign stock exchanges such as Hang Seng, ASX, Nikkei,

really thrilled me to continue to develop better technique to chart any stocks with clear definition

such as colored price bar, trend cluster just below volume and colored volume as well.

I used pivot point level as trigger to buy or cut loss stock on daily basis, drawing channel lines to

determine the major trend ahead. By segmenting the channel range into quarters, I can quickly

determine the near term resistance or support for the stock.

With bar by bar analysis, I am able to interpret the current underlying activities of the professionals to a certain degree of accuracy in very short term.

Subscribe to:

Posts (Atom)