Refer to the blog post on 3rd November, I wrote two posts....

On the first post, where I demonstrated on how OSIM price would continue to go higher with clear

strategy.

http://volume-price-spread-for-metastock.blogspot.com/2010/11/how-to-know-if-stock-will-continue-to.html

and on the 2nd post, I showed how where I took the trade on OSIM and gave clear indicator when I should

harvest the profits.

http://volume-price-spread-for-metastock.blogspot.com/2010/11/how-to-know-when-to-sell-when-stock-is.html

Till date, there is no sell signal yet. The stock has met my 1st target level of $1.60, a whopping 46% profits from my bought price of $1.12 in October, just merely 33 trading days of holding.

So if there is no sell signal now, where will the price be heading next? my price projection shows

a target near $2.10 in 1st quarter 2011. Hopefully, i am right on target again.

As you can see, I have covered how I traded Osim from the start and analyzed the trade along the

way in this blog, it is not a coincidence or lucky trade.

This trade is carefully planned and traded as it appears in my Diamond Scanning System.

This is one of the many trades that appear to me each time for analysis when pick up by the

Scanning System which is capable of detecting the unusual activities of any stocks and display

them for my further analysis for possible transaction the next day.

Till Then, Happy Profitable Trading.

Disclaimers: - No communication should be considered as financial or trading advice. - All information in this lecture/course/seminar are intended and solely for educational purpose only. - They do not constitute investment advice in any manner whatsoever or have any regard to the specific investment objectives, financial situation or individual needs of any particular persons receiving them. - Examples are used for illustrative purposes only and do not constitute investment advice.

Sunday, December 5, 2010

Saturday, December 4, 2010

The Power of Knowing When The Trend Has Ended or Just Started to Move North

|

| Add caption |

Hi There,

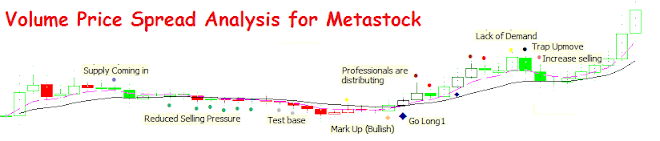

This chart demonstrate the Expert Indicators that appear automatically as price moves forward each day.

You may ask how do I know if the Stock Trend is going to Peak off and started to turn south.

Look at the chart above, as stock peaked each time, there are cluster of indicators showing that

the Stock is getting weak as its approaching would-be Peak level. E.g. Early January 2004, the

indicators showed that "Professionals are distributing" and followed by "Weakness coming in &

"Supply coming in". When cluster of indicators presented subsequently, denoted very powerful

trend change.

In 2006 and Mid 2007 demonstrated again the Capability of the trading system to show that the

Stock had once again peak the trend and weakness subsequently brought the stock trend down

the hill.

On the Bullish side, when a new uptrend is forming, the system is capable of identifying the exact

spot for Long trade. E.g Early 2003, before bullish indicator "Go Long1" were triggered, weeks before

, "Reduced Selling Pressure & Test Base" indicators appeared numerous times to confirm that

the base foundation was strong and tough to stage an upmove later. The stock moved from 2003

year lowest value of $0.17 and peak on March 2004 at $0.74. Enormously returns indeed.

This was not a concidence case, in March 2009, the stock based off with cluster of indicators

"Reduced Selling Pressure + Go Long1" appeared to indicate that the stock was once again ready for another upmove. The March 2009 Lowest value of $0.19 had moved north until today 3rd December

2010 of value $0.32.

If you ask me if the stock trend has reach its peak today, the answer is clearly "No", because the

cluster of bearish indicators have not appeared yet. Until then, just hold on to the stock and let the

stock to trend until its bend and turn south, by then, you will be presented with those cluster of bearish

indicators and its the time for Harvesting.

The job of a Successful Trader is to Trade Well Each Day, not Counting Daily Profits.

If you trade well each time, you will be rewarded naturally.

Till then, Happy Profitable Trading Ahead!

Monday, November 22, 2010

Power Strategy #3 - Go Long + Uptrend Arrow

Hi there,

I did a stock scan for end of day and the above stocks are picked up by the Blue Diamond Scanning System.

I am particularly interested in the first stock that is listed," Biosenor" which has good amount of transaction today.

Below is the chart which shows clusters of bullish signals, "Test Base + Go Long + Uptrend".

This is a powerpack combination and I am sure that this stock has more to show us in the near

term even the overall current market condition is weak and indecisive.

For the this trade, cut loss is set at $1.12 and below, the target is near $1.30 - $1.35, duration: 1month ++

Labels:

Diamond Trading,

Go Long,

Power Strategy,

Trading for a living,

Uptrend

Thursday, November 11, 2010

The Power of Diamond Trading for Maximum Returns

This stock is picked up by Diamond's Scanner for potential Long or Short Order this week.

The diagram above demonstrated how the Diamonds (Long or Short) were triggered in the past

and providing enormous profit advantage and reduced risk (cut loss was placed just below recent

support or resistance level).

Thanks for reading! More Profitable Trades ahead.

Wednesday, November 3, 2010

How to know when to sell when the stock is IN-THE-MONEY now?

With reference to Sample 8, a much earlier blog post as below:

http://volume-price-spread-for-metastock.blogspot.com/2010/10/sample-8-simple-strategy-to-cut-loss.html

I am going to demonstrate on how I manage to hold on to a stock until the trend is against me and I am force to take money out from the stock.

After transacting this stock on 21st Oct which counted as Day 1, I waited for the next 10days to see if the

cut loss will be triggered and I will be out of this game.

Fortunately, the stock trended higher after Day 1 until today which is the Day 10. Within 2 weeks, price managed to trade higher without trigger the cut loss system, so how am I going to manage this trade from here onwards. The strategy is clearly defined in the Sample 8 in this blog or click on the above hyperlink which will bring you to the post that I have created much earlier to demonstrate how I protect profits from a stock.

Back to this stock again, on Day 11, I will be switching to weekly chart instead of daily chart to monitor

the stock price. The reason is simple as I want to give the stock some room to move.The weekly chart is

good at reducing unwanted short term noises and provide smoother trend. Daily chart is easily manipulated and a good negative day can easily send you out of the game and stock continues to climb higher within the same week. Therefore inorder to prevent such incident to happen, I switch over to weekly chart to monitor the trend and channel strength while using the daily chart to detect short term weakness and price fluctuation.

So when will I take profit or exit this trade? From now, I have to wait for the Sell signal to appear in the future. When that happen, I will follow-up with another chart that explains why I decide to quit and take

profit instead. Till then, continue to follow me through this trade..It may take days, weeks or months ahead,

when the time has come to take profit, you will be informed without gimmick.

This is also to demostrate how anyone can trade a stock effectively which still working for earned income.

Best of all, you can enjoy trading stock at your comfort level and make subtantial income to pay for your luxurious toys or food.

Trading is not without RISK, you must accept RISK inorder to trade. I respect RISK and I manage IT.

Thanks for Reading!

http://volume-price-spread-for-metastock.blogspot.com/2010/10/sample-8-simple-strategy-to-cut-loss.html

I am going to demonstrate on how I manage to hold on to a stock until the trend is against me and I am force to take money out from the stock.

After transacting this stock on 21st Oct which counted as Day 1, I waited for the next 10days to see if the

cut loss will be triggered and I will be out of this game.

Fortunately, the stock trended higher after Day 1 until today which is the Day 10. Within 2 weeks, price managed to trade higher without trigger the cut loss system, so how am I going to manage this trade from here onwards. The strategy is clearly defined in the Sample 8 in this blog or click on the above hyperlink which will bring you to the post that I have created much earlier to demonstrate how I protect profits from a stock.

Back to this stock again, on Day 11, I will be switching to weekly chart instead of daily chart to monitor

the stock price. The reason is simple as I want to give the stock some room to move.The weekly chart is

good at reducing unwanted short term noises and provide smoother trend. Daily chart is easily manipulated and a good negative day can easily send you out of the game and stock continues to climb higher within the same week. Therefore inorder to prevent such incident to happen, I switch over to weekly chart to monitor the trend and channel strength while using the daily chart to detect short term weakness and price fluctuation.

So when will I take profit or exit this trade? From now, I have to wait for the Sell signal to appear in the future. When that happen, I will follow-up with another chart that explains why I decide to quit and take

profit instead. Till then, continue to follow me through this trade..It may take days, weeks or months ahead,

when the time has come to take profit, you will be informed without gimmick.

This is also to demostrate how anyone can trade a stock effectively which still working for earned income.

Best of all, you can enjoy trading stock at your comfort level and make subtantial income to pay for your luxurious toys or food.

Trading is not without RISK, you must accept RISK inorder to trade. I respect RISK and I manage IT.

Thanks for Reading!

How to know if a stock will continue to TREND HIGHER?

Look at the huge transaction day and wide price range as shown by the enormous volume bar

denoted by the black arrow.

Usually, the stock will be subjected to profit taking. As such, I need to know if the selling pressure

is strong enough to digest all the profits made in a day.

Using the high transacted day price as reference, obtain the Pivot Level for that day. As shown in

the chart, the Pivot Level is $1.20, therefore this value becomes the new profit protect level from

now.

As long as price continues to trade above $1.20 and above, I will continue to hold on to the stock until this level is breached or a new profit protect level is set after the price moves much higher.

In this way, I can secure some profits if the price starts to tumble below the Pivot Level.

The reason why many fails to survive in trading is due to lack of Money Management System which needs not to be complicated. You need to know when to sell or buy, when to cut loss or take profit.

Never be greedy to make another cent. When I sell, I choose to sell to the Ready Buyers and when

I buy, I choose to buy from the Ready Sellers and close my notebook to do my job as an employed

IT Engineer.

You need not stick to watch the stock price ticking real time, that will definitely kill you as a newbie.

I did that for nine solid months full time in 2003, great profits but intense stress and I hate to stress

myself while making money.

Trading should be fun and easy to do like watching a movie and indeed after years of improvising new

trading strategy, I develop this current trading system that can provide me with portfolio income while

working on earned income.

I can be reached at failureisnotachoice@gmail.com if you want to share your trading skills.

Thank you for reading again!

Power Strategy #2 - Test Base+ Go Long combination

After a weak market was triggered in January 21st 2010, the stock price tumbled $0.40 and found base

in early February as detected by expert signals (Price Pull Back Up and Demand Coming in).

For risk averse traders, this could be opportunity for trade but for my trading style, I would like to wait a little

longer to observe if the trend was indeed trending higher. I would wait for the price bar to change from Red Colored Bar to Green Colored Bar and the Trend Cluster at the bottom of the chart (just below Volume Bar) turned from Red to Green.

Luckily for me, I have a proprietary scanner that would pick up stock that meets such a strict criteria (Test Base + Go Long1) from the chart above.

This combination means that after some weaknesses in the background for sometimes, the stock is nolonger falling south (Stage 4) but starts to move sideway (Stage 1) to consolidate strength.

Once the strength is built up to move northward, a "Test Base" is usually good to know that the selling activities have been absorbed and price is ready to move up with no selling pressure.

With "Go Long1" picks up after "Test Base", I know that the Professionals are ready move this stock price higher definitely. Look at the chart above and see for yourself.

Again and again, this combination is always ready to pick up any stock that is ready to stage an upmove.

Although there is no certainty in trading, there is always the probability of a good setup with strict money

management scheme to capture this profit opportunity.

Thanks for reading and many Profitable Trades ahead!

Subscribe to:

Posts (Atom)