stock closely since mid december. If you have missed any of the post, the links as below.

http://volume-price-spread-for-metastock.blogspot.com/2010/12/241210-wilmar-has-fallen-19-pecent-is.html

http://volume-price-spread-for-metastock.blogspot.com/2010/12/171210-is-wilmar-ready-to-stage.html

The same question again, Is Wilmar ready to go up north from today's massive sell down?

Look at the price bar today, the closed is not above 50% of its day range but towards the day's low.

Although there is a sign of buying back at the end but this does not constitute a "buy order" yet.

If you think that it is cheaper now, think twice as it may get cheapest in weeks ahead.

Look at the wilmar chart today, if a trader has been trying to buy into the huge down day on each

occasion or averaging down.

Let see his portfolio performance.

Date Activity Lot Price

11/11/10 BUY 1 $6.30

22/12/10 BUY 1 $5.62

04/01/11 BUY 1 $5.50

------------------------------------------------------------------------------------

TOTAL 3 $17.42

-------------------------------------------------------------------------------------

AVERAGE/LOT 1 $5.80

LOSS/LOT (TODAY CLOSED - AVERAGE) -$0.30

This loss will continue to amplify if the stock price continues to fall day after day. Paper loss is REAL loss, don't be childish to think it is not. It is your real money in negative returns. Worse of all, funds are

held up too long waiting for the stock to turn back up again and some never able to survive again with

suspension or delisting issue.

So what will be the tell-tale sign that the stock may have bottom inorder to have a good entry and enjoy the joy ride soon after purchase...Check my blogsite for more information.

What to look out for this week?

Basically we need to see that the today's low is not violated for the next few sessions, what I would like to

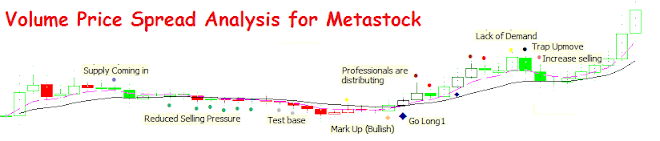

see for the next three sessions is to look out for test base bar or reduced selling pressure bar with very low volume, negative bar which closes within the body of today's bar. In Japanese candlestick, it should be classified as bullish harami. This will provide me with the tell-tale sign that the sellers are no longer motivated to sell down further and I would expect higher price from then. Another positive indication will be a bottom reversal bar when price opens lower than today's low and closes near the day high with enormous volume and this climatic bar actually covers at least 50% of the today's bar.

Another interesting aspect of my system is that when the trend change occurs, the price bar will turn

Green and the Trend Cluster below volume bar will turn Green too. So when price bar and trend

cluster are positive with other positive indicators alert, then I will consider to take the trade without fear.

In my opinion, I feel that Wilmar is likely to head lower towards the mid-term support at $5.25. Failure to

hold up, next will be the lower channel line (bear logo) around $5.00 mark. Till then, I have to relook into

the chart again.

As I am planning to look for long trade, until now I have not found the right timing to ride the upwave and

is fortunate to be staying sideway all these while when the stock continues to plunge.

For more information on how I prepare a stock chart for trading each time?

Youtube: http://www.youtube.com/watch?v=DhWgOq3BWHs

http://www.youtube.com/watch?v=nlNL8hCxq3E

http://www.youtube.com/watch?v=_nHsj_xSAhI&feature=related

Blogsite: http://volume-price-spread-for-metastock.blogspot.com/

Trading is a team sport!