Disclaimers: - No communication should be considered as financial or trading advice. - All information in this lecture/course/seminar are intended and solely for educational purpose only. - They do not constitute investment advice in any manner whatsoever or have any regard to the specific investment objectives, financial situation or individual needs of any particular persons receiving them. - Examples are used for illustrative purposes only and do not constitute investment advice.

Saturday, June 27, 2015

Thursday, March 19, 2015

Thursday, March 12, 2015

How my blue diamond scanner fared over the years?

How I make use of free trading website with virtual money of 1 Million dollar to test my proprietary scanners to

pick stocks for further analysis and fine-tune personal trading system?

Saturday, September 6, 2014

Extremely High Volume on the upper channel with positive day closed is it a good sign?

Looking at the extremely high volume bar and positive day closed, did it give you the confident to trade to the long side on the next day? Did the price go up the next day? if not, what had happened?

Shouldn't the price go up after such an exciting trading day?

If the price was not heading higher then what had happened? -

Could it be the start of a distribution so that the price can become cheaper again for the professionals to take advantage of?

what is the current critical support level that needed to watch closely?

What will happen if price break down this support level?

When trading, many questions run through my mind before I decided to make a trade. If there is doubt, always stand sideway to watch how the price trend will evolve before rushing in to take a stand.

Never rush into the Market, the Market will always be there even I am gone.

Happy Profitable Trading!

Friday, July 26, 2013

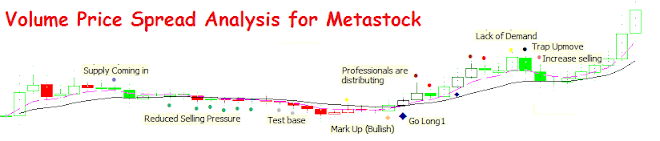

A Trading System that TELL THE TRUTH with propietary indicators and scanners

A system that provides descriptive events as the market unfold each day. This is the Trading Edge.

A time tested system that does not use complicated formulas to study the underlying demands and supply, no demand and no supply.

Seek to reveal what the Professional Activities in the market to a certain degree of accuracy.

But there is no sure thing in the market.

Always protect yourself with a risk management tool such as position sizing and chart analysis to seek out best probability of success vs profitability.

"Trading is a Team Sport"

Happy Profitable Trading 2013!

Monday, June 17, 2013

Online Simple Trade Management that I use in my Trading Plan

The following diagram illustrates how to use Position Sizer Calculator and Profit & loss Calculator

to make up a trading plan.

1) Enter the following information in the Dynamic Position Sizer Calculator

a) Max Cost: ; capital outlay for this trade

b) Risk: ; dollar amount of risk to take

c) Buy/Sell Price: ; Entry or Short Sell Price

d) Stop Price: ; Sell or Cover Short Price

e) Position Type: ; is it a Long or Short order

f) Shares to Buy/Sell: ; this will automatically determine the quantity to buy/sell

2) Enter the following information into the Profit & Loss Calculator

a) No. of shares ; taken from the auto-compute Position Sizer

b) Buy Price ; Entry Price

c) Cut Price ; Stop Price

d) Target Price: ; Near term resistance level

3) Once this is done, you will know the following

A) Risk to Reward Ratio ; whether a trade should be taken or walked away

B) Break Even Level ; when the trade will become profitable.

C) Potential Profit & Loss Amount

Tuesday, May 28, 2013

How I would trend trade a stock using Propietary Trading System?

How I would trade?

Point 1 : Take a trade after Blue Diamond Triggered

Let the price trends along the two Moving Averages 10EMA,30EMA.

as long as price does not fall below the longer term 30MA for 2 days or more

or the expert indicator "!Take Profits" appear

Point 2 : Along the way, when another Blue Diamond appears, it is an opportunity to

perform averaging up buy buying more lots.

Point 3 : As price trend higher, volatility increases until price starts to weaken and trigger

"!Take profits". This is the 1st sign of caution and get ready to exit if Point 4

condition happens.

Point 4 : Monitor the price closely after "!take profits" indicator alert, as long as there are two

price bars that consecutively close below the longer term 30MA (black line), just take profits.

Subscribe to:

Posts (Atom)