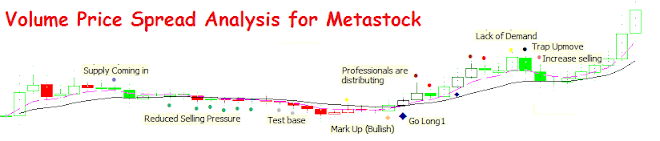

Looking at the extremely high volume bar and positive day closed, did it give you the confident to trade to the long side on the next day? Did the price go up the next day? if not, what had happened?

Shouldn't the price go up after such an exciting trading day?

If the price was not heading higher then what had happened? -

Could it be the start of a distribution so that the price can become cheaper again for the professionals to take advantage of?

what is the current critical support level that needed to watch closely?

What will happen if price break down this support level?

When trading, many questions run through my mind before I decided to make a trade. If there is doubt, always stand sideway to watch how the price trend will evolve before rushing in to take a stand.

Never rush into the Market, the Market will always be there even I am gone.

Happy Profitable Trading!